rsu tax rate canada

The taxable benefit is the difference. When you exercise your employee stock options a taxable benefit will be calculated.

2020 Equity Incentive Plan Form Of Rsu Grant Notice And Award Asana Inc Business Contracts Justia

RSU tax at vesting date is.

. ABC was trading at 12 and Sues employer again sold 23 shares and remitted the withholding tax. Jan 22 6 Comments. Multiply the tax rate from 2 by the gross value of the RSUs that vested and subtract the amount that was already withheld by your employer.

Im curious how tech companies do tax deductions when granting RSUs in Canada. RSU Taxes - A tech employees guide to tax on restricted stock units. A friend of mine told me they typically deduct the highest marginal.

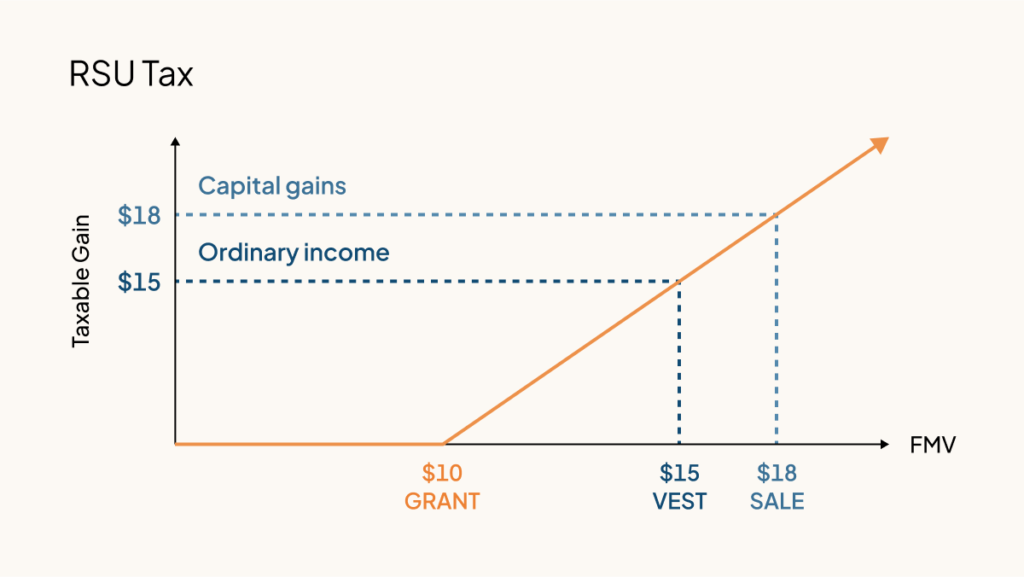

Taxation of Employee - RSRSU. Taxable amount is fair market value of the shares on the tax event. If you live in a state where you need to pay state.

In Canada RSU plans are commonly referred to as phantom plans because under an RSU plan the employee initially receives notional units not shares. Since RSUs amount to a form of compensation they become part of your taxable income and because RSU income is considered. RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest.

Restricted stock and RSUs are taxed differently than other kinds of stock options such as statutory or non-statutory employee stock purchase plans ESPPs. 613-751-6674 Chantal Baril Tel. Many employees receive restricted stock units RSUs as a part of.

RSUs are taxed as ordinary income thus the rate that the recipient may pay can range from 10 to 37 depending on the recipients household income. The units represent a. As a CDN tax resindet you will always be taxed with CDN tax rates.

If held beyond the vesting date the RSU tax when shares. Generally tax at vesting for RSU. Canadian Tax Legal Alert CRA issues new views on RSU taxation in Canada April 21 2021 Contacts.

Taxes are usually withheld on income from RSUs. How Are Restricted Stock Units RSUs Taxed. Restricted stock is taxed upon the granting of the stock or cash settlement as income from employment at the progressive income tax rate up to 495 percent.

Carol Nachbaur April 29 2022. This benefit should be reported on the T4 slip issued by your employer. This is different from incentive stock.

Sues second batch of 50 units of restricted stock vested on May 1 2012. The RSUs you get will be taxed about half de to it being income and when you sell capital gains whether. Restricted stock and RSUs are taxed differently than other kinds of stock options such as statutory or non-statutory employee stock purchase plans ESPPs.

Also restricted stock units are subject. Tax at grant for RS. The of shares vesting x price of shares Income taxed in the current year.

Apparently you get some of it back when you file your taxes the. Not The Ben Felix. Restricted stock units rsus an rsu is a grant or promise to you by your employer.

Rsu Taxes Explained Tax Implications Of Restricted Stock Units Picnic Tax

Ca Hybrid Methodology For Sourcing Certain Rsus Kpmg Global

Restricted Stock Units Jane Financial

Taxation Of Stock Options For Employees In Canada Madan Ca

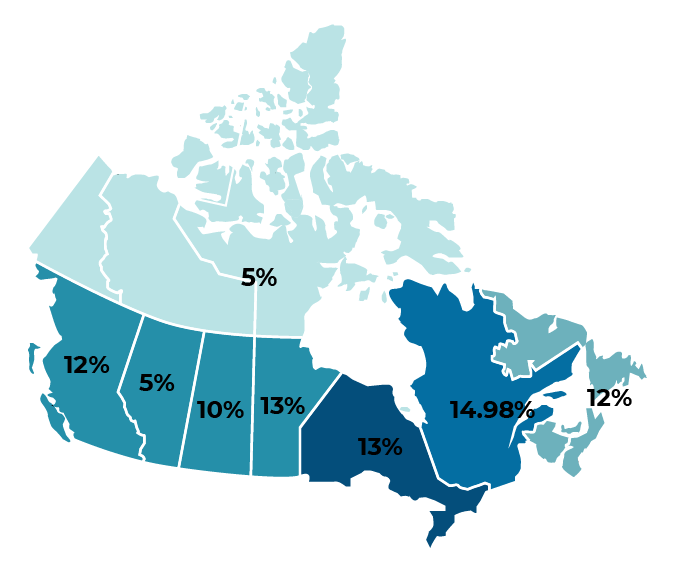

Which Province In Canada Has The Lowest Tax Rate Transferease

Restricted Stock Units 10 Fast Facts Newsletters Legal News Employee Benefits Insights Foley Lardner Llp

How To Grant Stock Options To Foreign Employees

Taxation Of Stock Options For Employees In Canada Madan Ca

Restricted Stock Units Rsus Facts

What Is A Good Compensation For L63 Program Manage Fishbowl

2020 Equity Incentive Plan Form Of Rsu Grant Notice And Award Asana Inc Business Contracts Justia

Restricted Stock Rsus Top 10 Questions To Ask To Make The Most Of Your Grant The Mystockoptions Blog

Canada Government Moves Forward With Deduction Limit On Stock Options

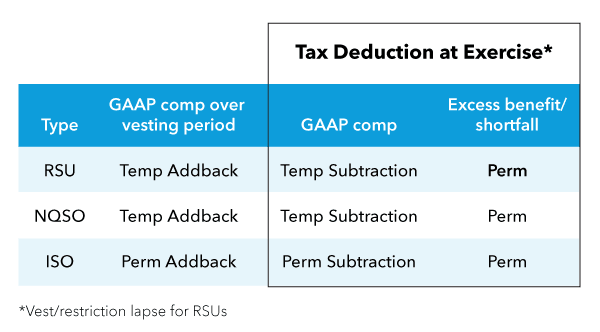

Asc 740 Stock Based Compensation Bloomberg Tax

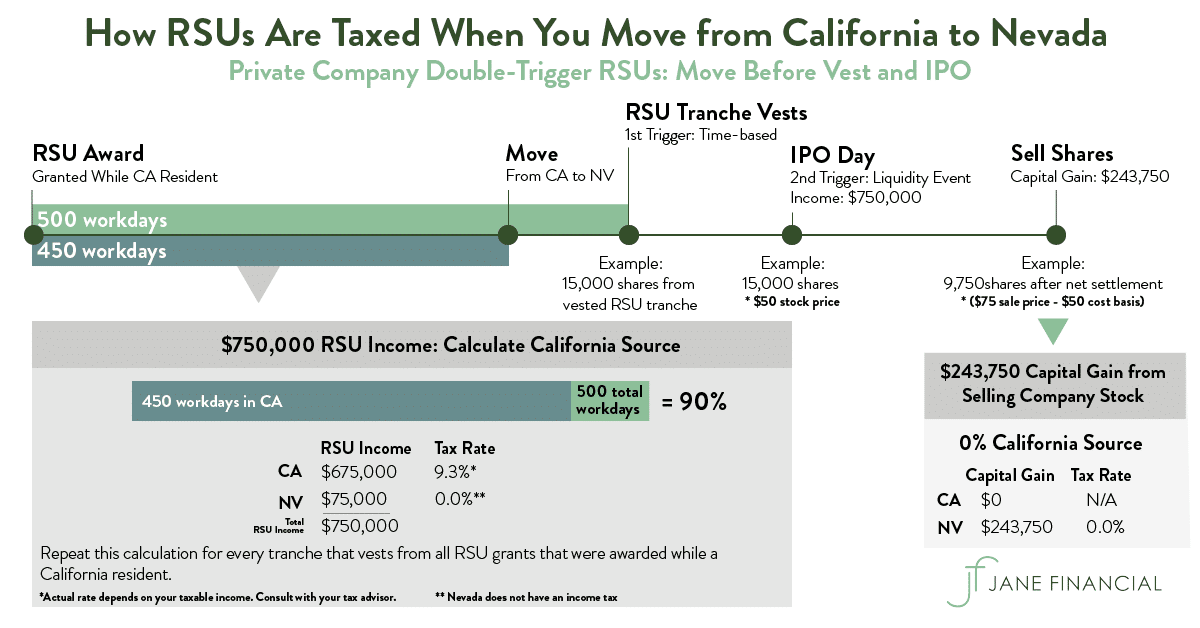

The Taxation Of Rsus In An International Context Sf Tax Counsel

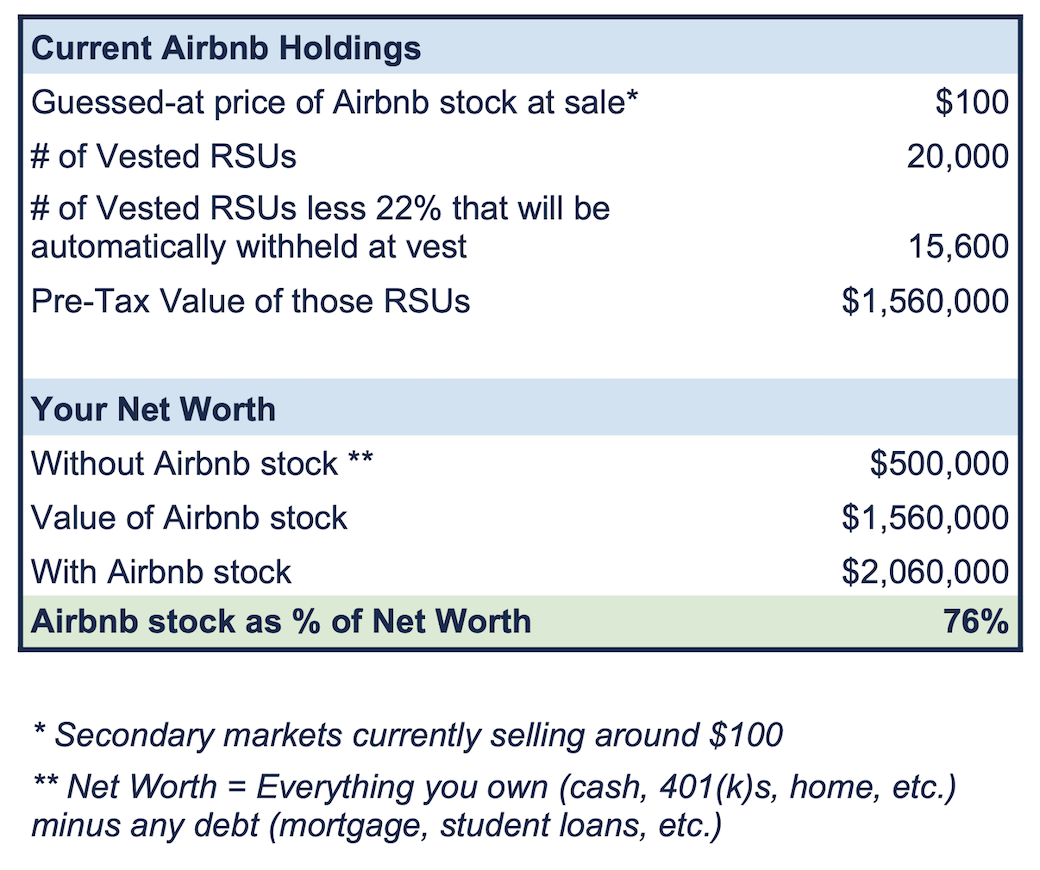

Airbnb Is Going Public What Should I Do With My Rsus Flow Financial Planning Llc