prince william county real estate tax assessment

The average homeowner will pay about 250 more in Real Estate taxes and fire levy taxes next year. Prince William County collects on average 09 of a propertys assessed fair market value as property tax.

Fillable Online Liamsdad V I R G I N I A In The Circuit Court Of Prince William County Cheri Smith Plaintiff V Liamsdad Fax Email Print Pdffiller

Prince william county real estate tax due dates 2021 Monday May 30 2022 Edit.

. Submit Business Tangible Property Return. Report High Mileage for a Vehicle. 4000 County Avg 6200.

View all 4 listings available in Prince William County with an average price of 293854. Hi the county assesses a land value and an improvements value to get a total value. Prince William County Virginia Home.

The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700. Submit Daily Rental Return. Ad Current Assessed Value of Property.

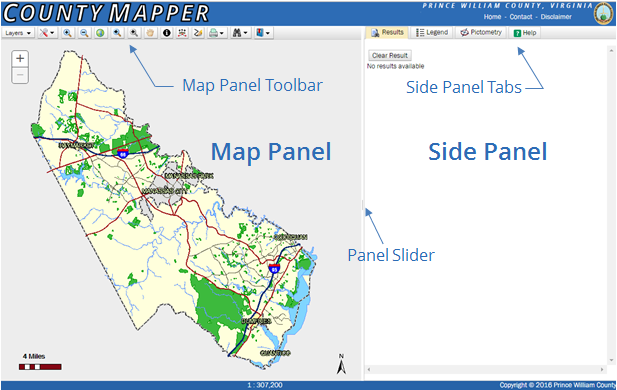

They are maintained by various government offices in Prince William County Virginia State and at the Federal level. Use both House Number and House Number High fields when searching for range of house numbers. 703 792 6780 Phone The Prince William County Tax Assessors Office is located in Prince William Virginia.

Actual taxes might differ from the figures displayed here due to various abatement and financial assistance programs. We Provide Homeowner Data Including Property Tax Liens Deeds More. Prince William Wants To Hike Property Taxes Introduces Meals Tax.

Every homeowner needs to pay taxes but not many states have low property tax ratesThis is why you have many ways to lower your tax bills from applying for a property tax exemption to. These candidates tax assessments are then matched. You can read more at Propety Taxes in.

Get driving directions to this office. Prince William County Budget Set For Approval Residents Can Expect To See Tax Bills Tick Up Wtop News. Search homes for sale in Prince William County VA for free.

Submit Consumer Utility Return. The Ultimate Guide to the Prince William County Property Tax Assessments. 18502 Corby Street 399000.

Submit Consumption Tax Return. At Tuesdays Board of Supervisors meeting county officials proposed a further reduction in the real estate tax rate from 1115 per 100 of assessed value to 103 in the budget for fiscal 2023. You can call the Prince William County Tax Assessors Office for assistance at 703-792-6780.

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Comments may be made by telephone at 804 722-8629 or via e-mail to assessorprincegeorgecountyvagov. Then they multiply that by the tax rate to get your property tax.

The county proposes a new 4 meals tax to be charged at restaurants. Remember to have your propertys Tax ID Number or Parcel Number available when you call. Prince William Virginia 22192.

The county assessed home. Prince William County Real Estate Assessor. Whether you are already a resident or just considering moving to Prince William County to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

Ad Find Out the Market Value of Any Property and Past Sale Prices. Prince William County has one of the highest median property taxes in the United States and is ranked 120th of the 3143 counties in order of. Report a Vehicle SoldMovedDisposed.

4379 Ridgewood Center Drive Suite 203. Enter Your Zip Start Searching. If you have questions about this site please email the Real Estate Assessments Office.

While the Office of Real Estate Assessor has attempted to ensure that the data contained in this file is accurate and reflects current property characteristics the County of Prince George makes no warranties expressed or implied concerning. Prince William County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Prince William County Virginia. Contact each County within 60 days of moving to avoid continued assessment in the County you are no longer living in and to be assessed accordingly by Prince William County.

For more information please visit Prince William Countys Department of Real Estate Assessments or look up this propertys current valuation. Prince William County Real Estate. Save View Detail Similar Properties.

1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title. Enter the house or property number. Avg Taxes in Prince William County.

Estimate Your Home values for Free Connect with Top Local Real Estate Agents. Then they get the assessed value by multiplying the percent of total value assesed currently 100. The Prince William County Assessor is responsible for appraising real estate and assessing a property tax on properties located in Prince William County Virginia.

For example if the total tax rate were 12075 per 100 of assessed value then a property with an assessed value. Enter street name without street direction NSEW or suffix StDrAvetc. Learn all about Prince William County real estate tax.

Moving a vehicle INTO Prince William County from another state please register your vehicle and change of address with the Virginia Department of Motor Vehicles DMV 804. They are a valuable tool for the real estate industry offering. Submit Transient Occupancy Return.

All real property in Prince William County except public service properties operating railroads interstate pipelines and public utilities is assessed annually by the Real Estate Assessments Office. Often a resulting tax assessed. Submit Business License Return.

Please call the assessors office in Prince William before you send documents or if you need to schedule a meeting. These records can include Prince William County property tax assessments and assessment challenges appraisals and income taxes. How property tax calculated in pwc.

If you own real property in Prince William County you need to know how property tax assessments work. If you have general questions you can call the. Request a Filing Extension.

Ad Uncover Available Property Tax Data By Searching Any Address.

Prince William County Sheriff S Office Wikiwand

Prince William Wants To Hike Property Taxes Introduces Meals Tax

Gop Prince William Supervisors Criticize Tax Increase Headlines Insidenova Com

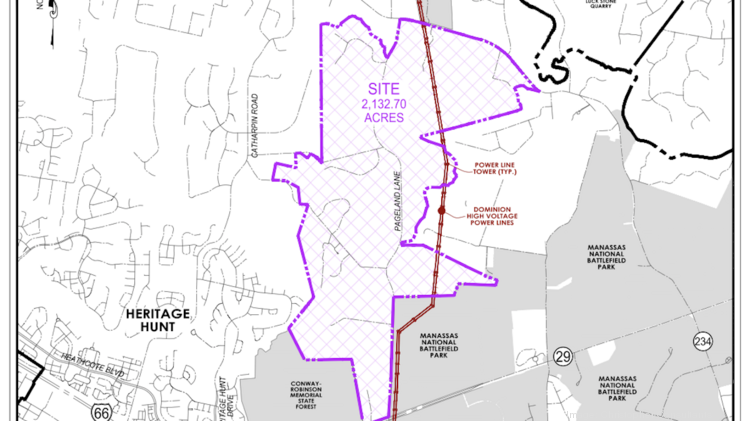

Data Center Opportunity Zone Overlay District Comprehensive Review

Class Specifications Sorted By Classtitle Ascending Prince William County

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Prince William County Park Rangers New On Call Number Effective April 1 2022

Prince William County Warranty Deed Form Virginia Deeds Com

Qts Prince William Landowners Propose Massive Data Center Campus Washington Business Journal

First Half Of 2020 Real Estate Taxes Due July 15 Prince William Living

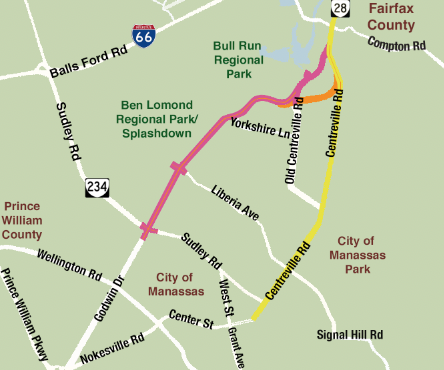

Prince William Area Leaders Call For Reconsideration Of Route 28 Bypass Headlines Insidenova Com

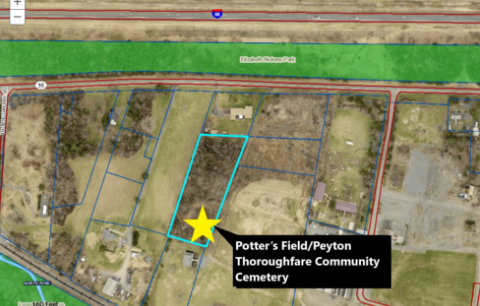

Prince William Board Of County Supervisors Approves Land Purchase In Historic Thoroughfare Community